Lenders will start accepting Paycheck Protection Loan (PPP) applications today, April 3rd, for small businesses and sole proprietors. Independent contractors and self-employers can begin submitting applications on April 10th. This program provides potentially forgivable loans in amounts to cover 2.5 months of payroll or $10 million (whichever is less).

To apply for a PPP:

- Review the application and gather the necessary materials such as payroll tax filings, proof of lease payments, proof of mortgage payments, and proof of utility payments

- Get in contact with your accountant and/or bank that pays out your business’s payroll. Ask your lender if it is authorized to process your Paycheck Protection Program loan.

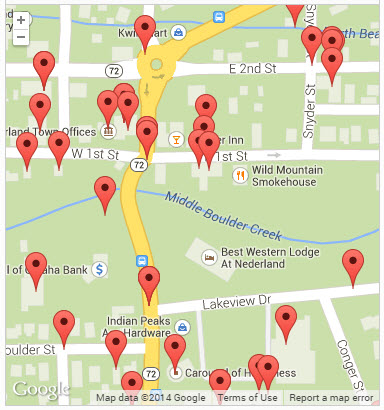

- If you are not connected to an authorized lender, you can search for an eligible lender here. (which currently shows headquartered bank locations)

- If you are unable to find an eligible lender, you contact the local Colorado SBA District Office. We are also working on a list of eligible lenders to share and post in the near future. Contact your local SBDC who can help you navigate this process.

The PPP is a part of the CARES act enacted last week. We encourage you to apply for this program and also encourage you to review all of the grants and loans that are now available to you through this Act.

Available Federal Grant and Loan Products include:

- Economic Injury Grant (Note: You must opt into the Grant while completing loan application)

- Economic Injury Disaster Loan

- Paycheck Protection Program

- SBA Express Bridge Loan

Note: You have the ability to wait to accept a product, loan, or grant after you apply and are approved. Depending on your situation, a prudent action would be to apply to multiple products and as you weigh your options and learn more of the intricacies of how they interact together, you can then make additional informed decisions on how you will choose to use and expend each of the grants and loans.

For additional information: